Benefit from the synergies

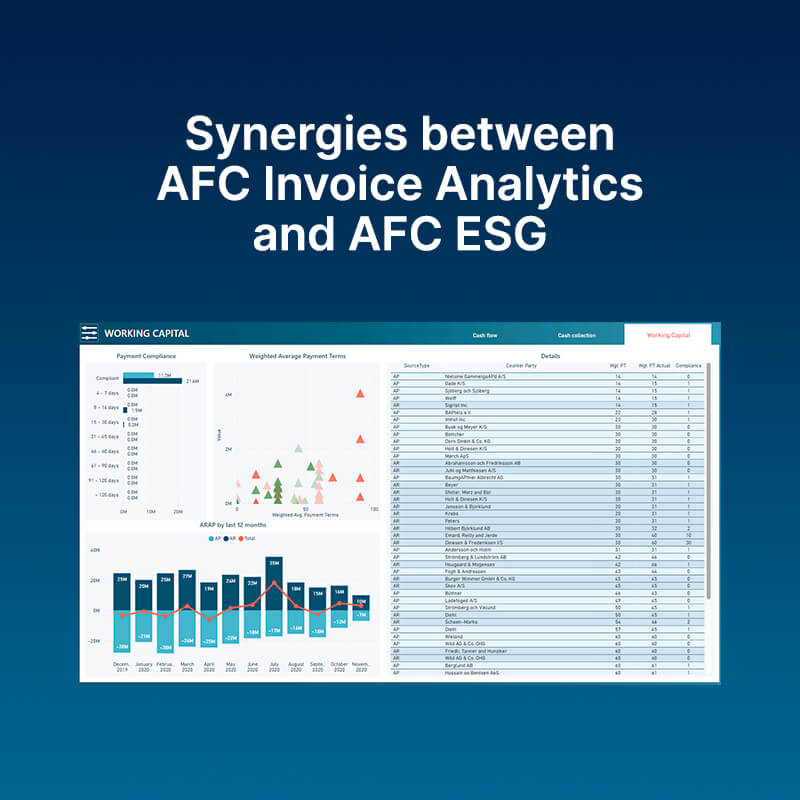

We see clear synergies between profitability and sustainability reporting, with the finance transactions being the common denominator as input source (and not only relevant to core consolidation):

- EU Taxonomy reporting classifies revenue, OPEX and CAPEX into sustainable or non-sustainable activities,

- ESG KPIs such as “Energy intensity,”

- Spend-based carbon accounting on scopes 1, 2 and 3,

- Payment compliance KPIs,

- Etc.

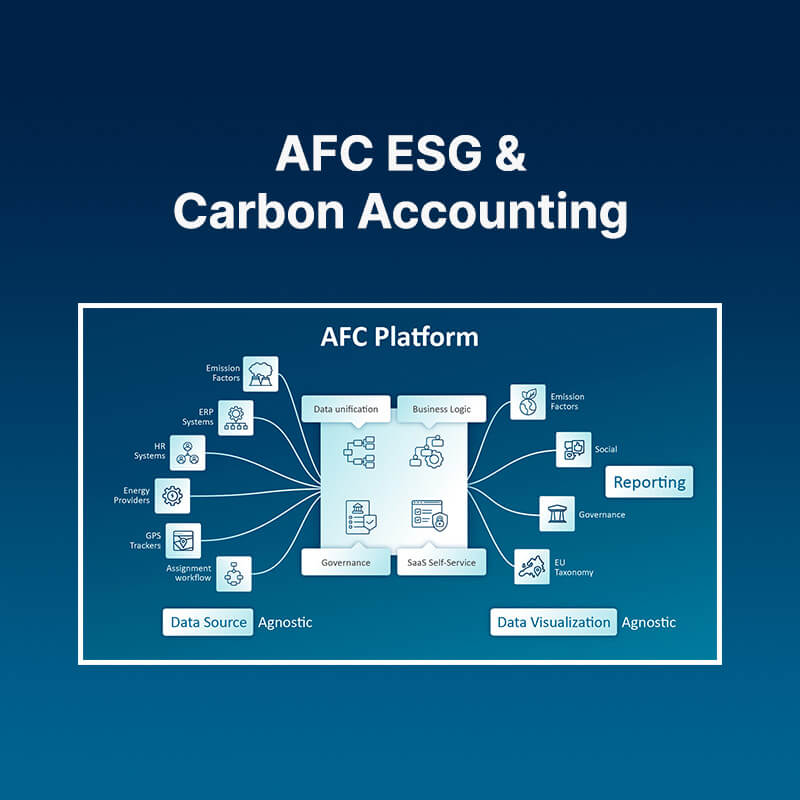

By selecting the same supplier for the financial consolidation as well as the sustainability reporting according to the EU Taxonomy, CSRD or equivalent, you will benefit from one system or platform – and thereby one truth.

Moreover, regardless of the method used to track the carbon accounting the official ownership percentage will be the decisive factor when deciding where to recognize and account for CO2 emissions on scope 1, 2 and 3. This requirement is basic master data and functionality in any proper consolidation tool.

Gain Control via Financial Transactions

At Solitwork, we believe in the value of gaining control of the carbon footprint by using the data you already have available, i.e. the posted expenditures. Spend-based carbon accounting is quicker and less expensive, and it immediately helps you to get started and improve the accuracy of your CO2 reporting intelligently and gradually where it really matters.

In addition, an extensive number of emission factors based on the unit “money” is already publicly available and recognized to convert financial transactions into CO2. These factors cover not only several types of activities (e.g. electricity, heating, diesel fuel etc.), they also cover detailed geographical regions.

Furthermore, we put trust into the financial transactions as they are audited, and generated from controlled processes in the ERP systems. Moreover, based on our experience, the ESG reporting is quite often tied up in the finance departments, so from an organizational point of view it would often also make sense to anchor the sustainability reporting here.

By choosing the same supplier for the sustainability reporting as well as for the financial consolidation you will also benefit from a “money vs. CO2 emissions” perspective in your management report.

Ensure a Proper Audit Trail

In the future, ESG data will be audited like the financial transactions included in the traditional annual reports, i.e. you need to document your ESG numbers.

The documentation includes explaining the audit objectives, especially with regards to completeness, accuracy, and occurrence. However, this can be difficult without a proper system to keep track of the data sources, data contributors, emission factors, comments etc.

We consider ourselves as data experts, with +20 years of experience handling finance data with integrity and care, always keeping a transparent audit trail. Hence, we consider Solitwork as the obvious data partner when it comes to the handling of your ESG related data.