Solitwork for CFOs

Enable effective financial decision-making

Financial Close & Consolidation is an all-in-one solution designed to ensure data transparency across your organisation, automate your financial processes and empower smarter decision-making.

Book a demo

Trusted by leading companies

Helping CFOs simplify financial complexity

Our software is designed to optimise key financial processes, providing advanced tools for automation, analysis, compliance, cash flow management, and integrated reporting.

Automated financial closing

Streamlines the financial close by automating data collection, reconciliation, and consolidation.

Vertical analysis and drill-through

Enables in-depth analysis by allowing users to explore data across multiple levels.

Consolidation

Flexible consolidation tool providing possibilities of vertical reporting and drill through across entities.

Cash flow optimisation and analysis

Delivers insights to improve cash flow management, forecasting and working capital.

Testimonial

Appreciated by customers

We are proud to be working with and deliver solutions for industry leaders worldwide.

"We evaluated different suppliers but quickly decided on Solitwork. They presented a flexible and competitive end-to-end platform that met all our needs across the group. Solitwork has strengthened our finance team with better tools and deeper insights into data. We have automated many of the tasks we previously spent hours on in Excel. And with the time saved and the easy access to insightful data, we can deliver much better business partnering to our stakeholders."

Head of Finance

Why choose Financial Close & Consolidation?

Financial Close & Consolidation helps businesses adapt to growth and stay ahead in complex financial landscapes through automation, integrated reporting, and advanced analytics.

Key component

Consolidation

Automate financial closing processes for both internal and external statements with a user-friendly self-service platform. Leverage flexible analysis and drill-through tools to gain deeper insights. Adapt to changing data demands by establishing relevant dimensions and allocation matrices.

Key components

IFRS 16

Provides a complete asset ledger for contract renewals, change tracking, and recognition, ensuring a clear audit trail.

Key components

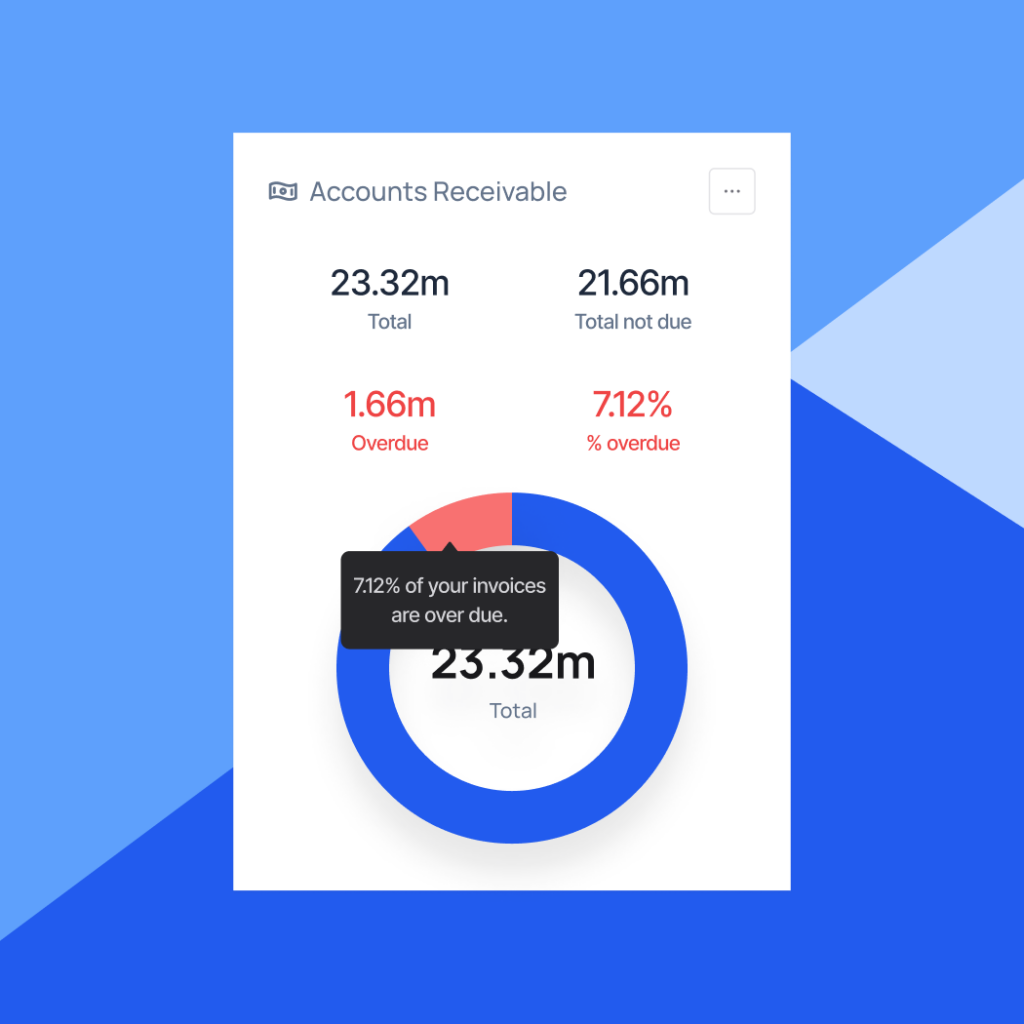

Invoice Analytics

Optimizes cash flow by improving working capital management, refining payment terms, and enhancing cash collection.

Key components

Planning Features

Provides rolling forecasts and budgeting based on key drivers, making scenario planning easy with flexible parameters, and streamlining financial planning across the organisation.

The check list

Features and capabilities

- Legal consolidation at single entities, sub groups and top group level

- Management consolidation at any level in the dimension

- Investment note (incl. group asset)

- Two account hierarchy perspectives (internal/external account structure)

- Recognition of investments at either equity value or cost

- Consolidation in both Local GAAP and IFRS perspective

- Automated cash flow set up by combination of account and movement type

- Automated reclassifications set up as single or group of accounts (e.g. VAT

liability to VAT asset)

- Intercompany reconciliations and eliminations

- Intercompany matrix overview

- Create valuable insights by bringing together your financial data and data from your operational systems

- Possibility to allocate transactions within the management dimension for

business line reporting purposes

- Data load from ERP will always be reconcilable to ERP

- Possibility to close periods and those late postings will then be reversed and referred to next open period

- Manual adjustments (manual, GAAP etc.) can be tagged with separate journal having transparency

- Rules in AFC tagged with separate journals explaining the reported result

- Currency conversion and adjustments from book value currency to two reporting currencies

- Automated load of exchange rates and periodic conversion using either average or month close rates

- Possibility to enter specific set of rates for e.g. budget

- IP and MS 2-factor authentication for all users

- Possibility to limit user access to both AFC web app modules and cube data

- Wiki articles describing AFC and “how to” supporting the AFC web application self service possibilities

Book a demo

Ready to take your finance to the next level?

Discover how our advanced tools for analytics, forecasting, and consolidation can help empower your business to grow.

Book a demo