ESG jobs and required qualifications

What Qualifies an ESG Professional?

As sustainability concerns continue to shape business practices, the demand for Environmental, Social, and Governance (ESG) professionals is on the rise. With many of these jobs anchored in the finance function, there are interesting similarities and overlaps between the skill sets needed for analysing finance data and ESG data. As reporting has developed from a prose text about sustainability strategy and into reporting on data driven KPIs based on regulation and frameworks, the required competences have developed as well.

In this article, we will share experiences from own workforce and discuss the skills required for success in this field.

ESG Reporting Anchored within Finance

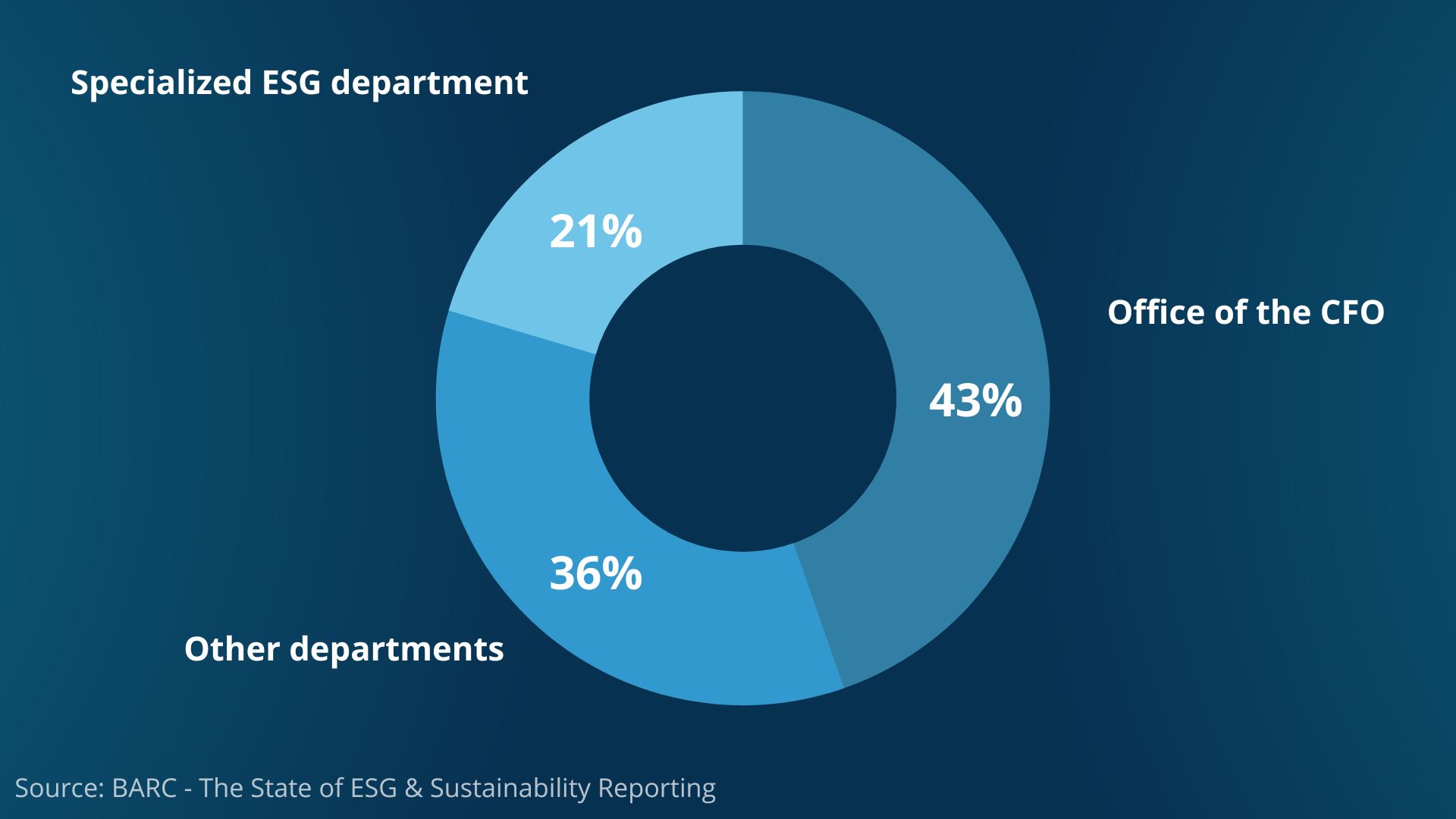

The organizational anchoring of ESG reporting is being addressed in several different ways. However, two approaches have emerged as the most widely adopted: Anchoring in the office of the CFO or in a specialized ESG department. We even experience the specialised ESG departments to be anchored within Finance. The anchoring of ESG in the CFO area makes sense, as we see ESG reporting as a natural part of the management reporting.

As with all known areas of data measuring; you get what you measure! And people within the accounting/controlling/finance area are generally very skilled when it comes to dealing with data and figures. The trend is also driven by the recognition that ESG factors can have a significant impact on a company’s financial performance, and to emphasise the importance, we even see some of the largest companies in Denmark, incorporate ESG as part of the management’s incentive programme.

In addition, integrating ESG into financial reporting allows companies to demonstrate their commitment to sustainable practices and transparency to stakeholders – a routine already very familiar to the finance function due to the existing financial reporting to stakeholders.

In addition, integrating ESG into financial reporting allows companies to demonstrate their commitment to sustainable practices and transparency to stakeholders – a routine already very familiar to the finance function due to the existing financial reporting to stakeholders.

These similarities highlight the need for ESG data to be treated with the same rigor and attention to detail as the financial data, and for organizations to establish robust ESG reporting frameworks to ensure the accuracy and transparency of their sustainability reporting.

Similarities and Overlaps between Finance and ESG Data

When it comes to ESG reporting, there are interesting similarities and overlaps with financial reporting. For example, ESG data is subject to audit, just like financial data, and is expected to meet audit objectives such as completeness and accuracy.

Additionally, internal controls and the internal control environment are crucial to ensure the reliability of both financial and ESG data. This includes establishing effective control procedures, monitoring the quality of data, and ensuring compliance with relevant regulations and standards.

Another similarity is the importance of maintaining a clear audit trail, which enables auditors to trace the origin and flow of ESG data to ensure its integrity.

As ESG factors can have a significant impact on a company’s financial performance, the need for timely and precise ESG data becomes even more critical.

These similarities highlight the need for ESG data to be treated with the same rigor and attention to detail as the financial data, and for organizations to establish robust ESG reporting frameworks to ensure the accuracy and transparency of their sustainability reporting.

Sharing Experiences from Own Workforce

At Solitwork, a vast number of our colleagues have a financial reporting/controlling and/or auditing background. To remain loyal to Solitwork’s core strategy of a being a trustworthy and professional sparring partner towards our customers, our team of skilled financial reporting professionals will also have to add adequate ESG qualifications and skills to their core competences.

To us, it is thus a natural step to actively involve and upskill the ESG competencies of the finance people as companies start to integrate and anchor the ESG reporting within the Finance area. Reason is the similarities and overlap in the fields described in the previous section.

Jakob Hildebrandt Jensen (Senior Business Analyst) and Sif Lynge Andersen (Senior Manager, Business Development) are examples on Solitwork consultants developing from audit and financial reporting experience into ESG, as professionals developing and implementing our own ESG product internally and with our customers. They are sharing their ESG skillset recommendations:

- Understand principles of ESG data and required reporting, including acceptance of everything being agile and ability to thrive in agility – sit down and read the ESRS standards and keep yourself up to date by frequent news reading.

- Analyze the company you work with and assess relevant data points to report using double materiality assessment, including understanding stakeholders weighting of important factors – bring in audit competencies from materiality assessments, but keep in mind this is not only about numbers.

- Process ESG data with same integrity and care as with financial transactions – remember to establish internal controls to comply with classic audit objectives and ensure audit trail.

- Communicate not only the importance of ESG reporting – focus on explanations and interpretations of presented data to support employee behavior, decisions, and strategy.