International ESG survey confirms that “Best-in-Class” companies have invested in new ESG technologies

Will you be Best-In-Class?

This article is based on key results from the German consultancy firm BARC’s ESG study from April 2023. Initially, we will argue why it is important for companies to start now on their ESG journey, followed by Solitwork’s approach on how they get started in the best and most efficient way.

Finally, we emphasize that Best-in-Class companies are those investing in new ESG technologies!

Do not postpone – Start NOW!

The CSRD is the primary framework used for ESG reporting in Europe, as 50 % of all companies starts here. The first companies must comply with the standards already in 2024, and in the following years even more companies will become applicable to ESG reporting.

Although for some companies the deadline may seem to be far into the future, our strong recommendation to all companies is to start NOW on their ESG journey!

Stakeholders are forcing sustainability, and according to the BARC study, 58% of the participating survey companies rate improved reputation towards their customers as the most important driver of their ESG reporting.

Other arguments in favor of an early start are:

- To ensure compliance towards regulations

- Improve the overall reputation with employees

- Increase transparency towards external stakeholders like financial markets, suppliers etc.

- To become confident in the reporting of the new dimension of numbers (CO2 etc.)

- To enable monitoring the improvements derived from the company specific ESG strategy and related targets

How to get your ESG journey off to a good start?

The experience we have gained from from existing customers as well as during our many sales meetings shows that very often the responsibility for the ESG reporting is placed with the CFO; either with the CFO personally, the Head of Finance or a nominated person from Controlling. In certain cases, we even see specialized sustainability departments being anchored within the CFO area. Our experience is also being confirmed in the BARC study.

As with all known areas of data measuring; you get what you measure! And people within the accounting/controlling/finance are generally very skilled when it comes to dealing with data and figures.

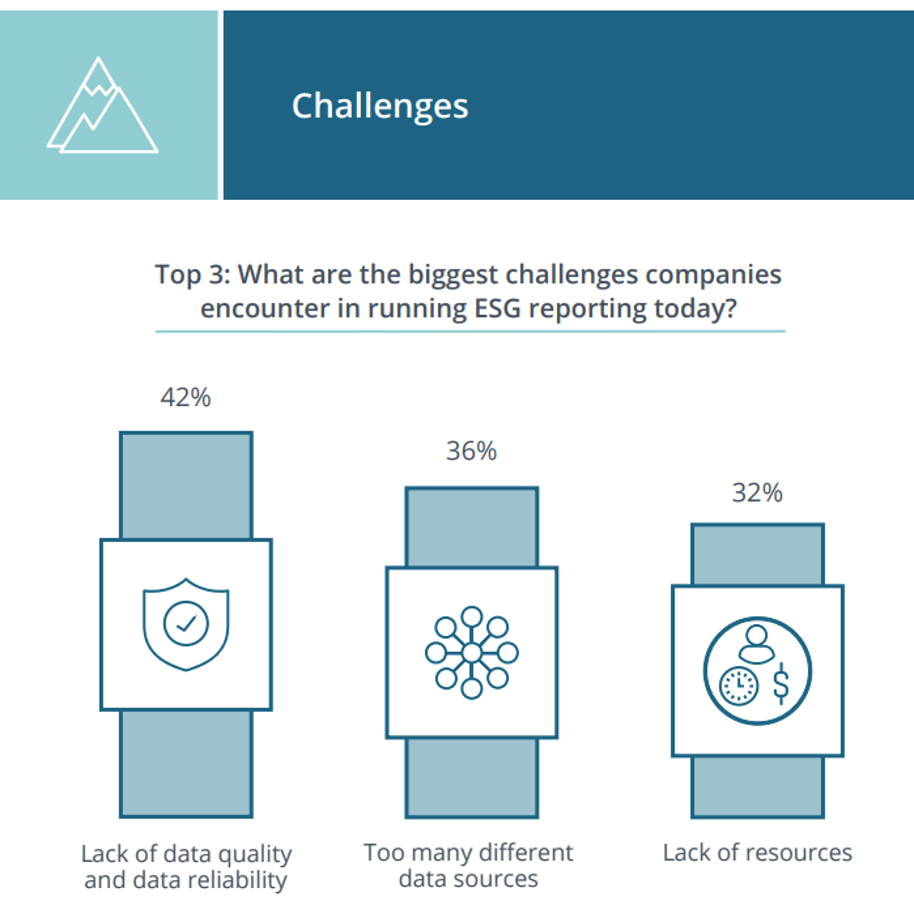

However, even the finance staff is often challenged when it comes to gathering the data required for a transparent and reliable ESG reporting. The biggest challenges encountered are:

- The lack of data quality and data reliability

- Too many different data sources

- Lack of resources

- Too many manual tasks to gather the required data

Especially when it comes to the data required for the complex CO2 reporting, the challenges become obvious. Activity-based data such as kilometers, kilo watt hours, liters are not always easy to identify and extract. In addition, it is often difficult to relate to and verify the new measuring dimension “CO2”.

Our approach on how to get started with the complex CO2 reporting is thus clear: Use the data you already have and know, i.e. your financial transactions. Start your ESG journey by gaining oversight and control using a spend-based approached for your CO2 calculations!

Not only are the financial transactions known to the people working with them daily. They are also complete, accurate and verified/audited. In addition, your spend-based calculated CO2 figures will provide you with a qualified benchmark as you develop and fine-tune your data towards activity-based calculations.

Become Best-in-Class in terms of ESG reporting

According to the BARC survey, companies investing in new ESG technologies are generally rated better than those who do not, as 72 % of those considered Best-In-Class are already using ESG technologies in their data collection process.

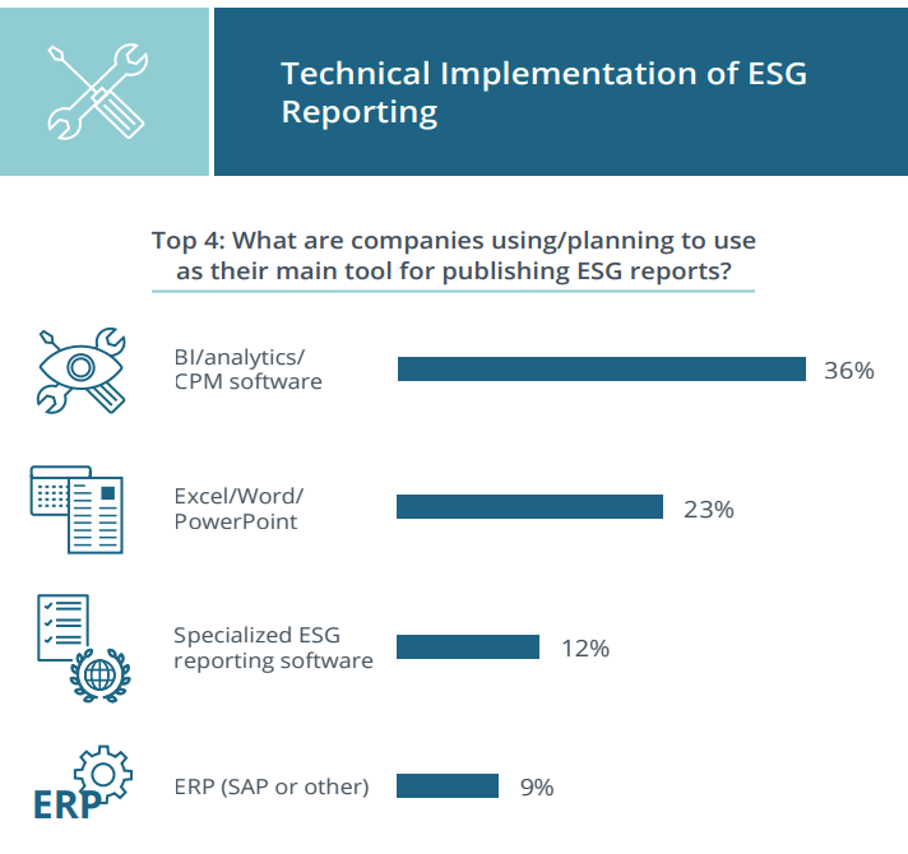

Furthermore, around one half of all participating companies plan to use an ESG software or even specialized ESG software as the main tool for generating their ESG reports.

On the other hand, one fifth of the participating companies tend to still plan with Excel/Word/PowerPoint as the main ESG reporting tools! Most of these companies – will in our opinion – be facing significant challenges as the complexity in terms of regulations and the expectations from internal and external stakeholders will increase. Furthermore, they will have to invest a significant number of resources in collecting and documenting their ESG data.

With our Carbon Accounting solution, you can start from any ambition level you desire. It allows data integrations to on-prem or cloud sources, with additional possibility to collect data via Excel templates in a structured workflow. And it allows all input units (money, kwh, liters, hotel stays, kilometers etc.). It even allows several input units for the same reporting area (e.g. business travel – flights), meaning that you can set up your advanced carbon accounting rules in several layers and easily set the primary source for your CO2 total.

It is easy-to-use, easy-to-implement and a very cost-efficient way to get started on your ESG journey in general and to become the Best-in-Class!