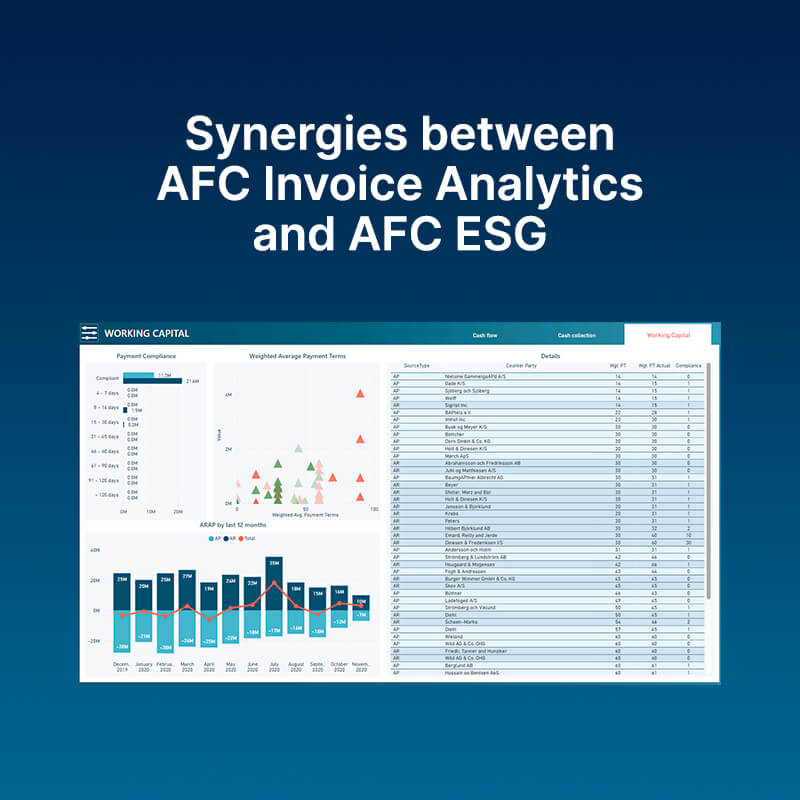

Profitieren Sie von den Synergieeffekten

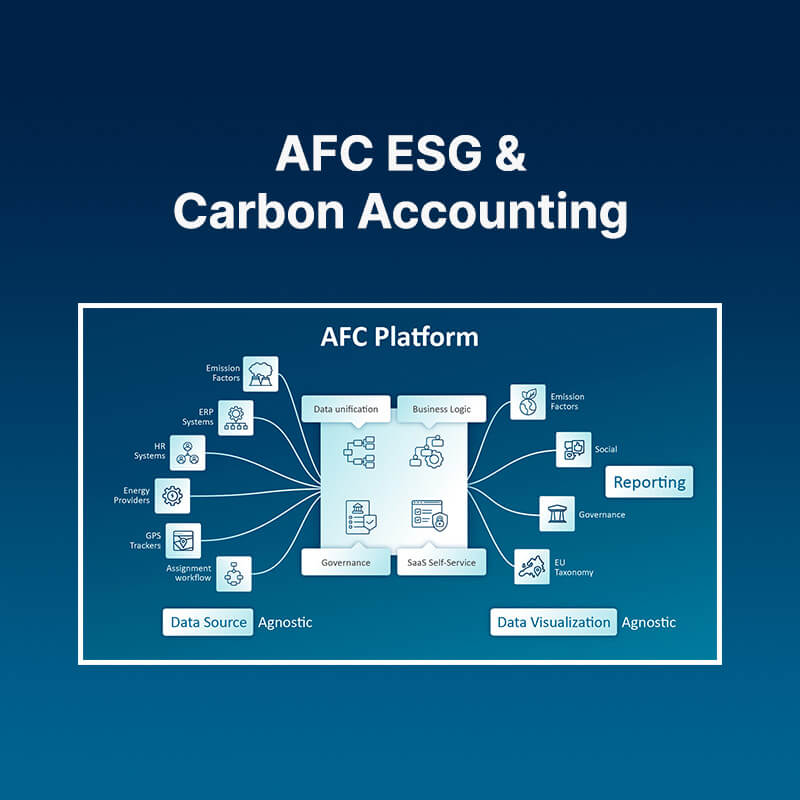

Wir sehen klare Synergien zwischen Rentabilitäts- und Nachhaltigkeitsberichterstattung, wobei die Finanztransaktionen den gemeinsamen Nenner als Inputquelle darstellen (und nicht nur für die Kernkonsolidierung relevant sind):

- Die EU-Taxonomie-Berichterstattung klassifiziert Einnahmen, OPEX und CAPEX in nachhaltige und nicht nachhaltige Aktivitäten,

- ESG-KPIs wie "Energieintensität" und

- Ausgabenbasierte Kohlenstoffbilanzierung für die Bereiche 1, 2 und 3,

- KPIs zur Einhaltung der Zahlungsvorschriften,

- Etc.

Durch die Wahl desselben Anbieters für die Finanzkonsolidierung und die Nachhaltigkeitsberichterstattung nach der EU-Taxonomie, CSRD oder gleichwertig, profitieren Sie von einem System oder einer Plattform - und damit von einer Wahrheit.

Unabhängig von der Methode, die zur Verfolgung der Kohlenstoffbilanzierung verwendet wird, ist der offizielle Eigentumsanteil der entscheidende Faktor bei der Entscheidung, wo die CO2-Emissionen in den Bereichen 1, 2 und 3 anerkannt und verbucht werden sollen. Diese Anforderung ist eine Grundvoraussetzung für Stammdaten und Funktionen in jedem geeigneten Konsolidierungsinstrument.

Kontrolle über Finanztransaktionen erlangen

Wir bei Solitwork sind davon überzeugt, dass es sinnvoll ist, die Kontrolle über den CO2-Fußabdruck zu erlangen, indem Sie die Daten nutzen, die Ihnen bereits zur Verfügung stehen, d. h. die verbuchten Ausgaben. Die ausgabenbasierte CO2-Bilanzierung ist schneller und kostengünstiger und hilft Ihnen, sofort loszulegen und die Genauigkeit Ihrer CO2-Berichterstattung intelligent und schrittweise dort zu verbessern, wo es wirklich wichtig ist.

Darüber hinaus ist bereits eine große Anzahl von Emissionsfaktoren auf der Grundlage der Einheit "Geld" öffentlich verfügbar und anerkannt, um finanzielle Transaktionen in CO2 umzurechnen. Diese Faktoren decken nicht nur verschiedene Arten von Aktivitäten ab (z. B. Strom, Heizung, Dieselkraftstoff usw.), sondern auch detaillierte geografische Regionen.

Außerdem vertrauen wir auf die Finanztransaktionen, da sie geprüft sind und aus kontrollierten Prozessen in den ERP-Systemen generiert werden. Zudem ist die ESG-Berichterstattung erfahrungsgemäß häufig in den Finanzabteilungen verankert, so dass es auch aus organisatorischer Sicht oft sinnvoll wäre, die Nachhaltigkeitsberichterstattung hier zu verankern.

Wenn Sie denselben Lieferanten für die Nachhaltigkeitsberichterstattung und die finanzielle Konsolidierung wählen, profitieren Sie auch von einer "Geld vs. CO2-Emissionen"-Perspektive in Ihrem Lagebericht.

Sicherstellung eines ordnungsgemäßen Prüfpfads

Künftig werden die ESG-Daten wie die Finanztransaktionen in den traditionellen Jahresberichten geprüft, d. h. Sie müssen Ihre ESG-Zahlen dokumentieren.

Zur Dokumentation gehört die Erläuterung der Prüfungsziele, insbesondere im Hinblick auf Vollständigkeit, Genauigkeit und Vorkommen. Dies kann jedoch ohne ein geeignetes System zur Nachverfolgung der Datenquellen, Datenlieferanten, Emissionsfaktoren, Kommentare usw. schwierig sein.

Wir betrachten uns selbst als Datenexperten mit mehr als 20 Jahren Erfahrung im Umgang mit Finanzdaten mit Integrität und Sorgfalt, wobei wir stets einen transparenten Prüfpfad anlegen.Daher betrachten wir Solitwork als den offensichtlichen Datenpartner, wenn es um den Umgang mit Ihren ESG-bezogenen Daten geht.